Thursday, December 31, 2015

<>*<>*<> OUT 2015~~ IN 2016 <>*<>*<>

<>*<>*<> - WISHING YOU A NEW YEAR THAT’S …. SPARKLING WITH FUN … BURSTING WITH JOY … & CRACKLING WITH LAUGHTER !~!~! <>*<>*<>

Wednesday, December 30, 2015

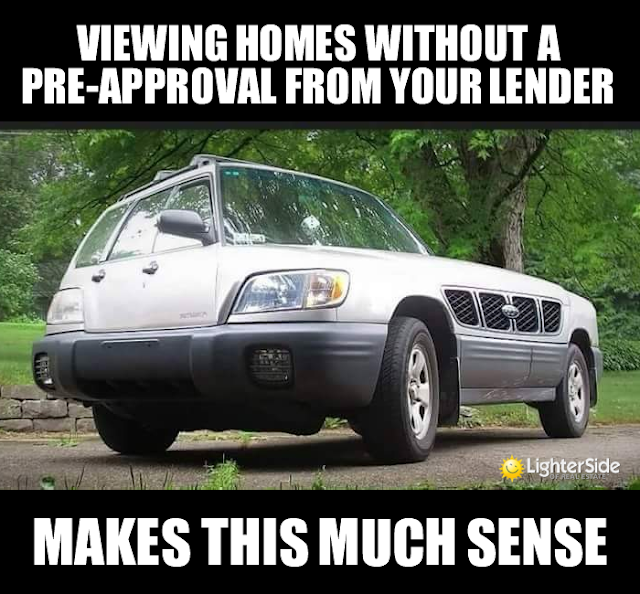

<><> MAKING SENSE WHEN BUYING A HOME <><>

<><><> THIS IS YOUR STARTING POINT WHEN ENTERING THE MARKET TO PURCHASE A NEW HOME <><> FIRST TIME BUYERS OR FOR AN UPGRADING HOME PURCHASE <><> LET ME POINT YOU IN THE RIGHT DIRECTION <><> CALL 909/ 910.2481 FOR CJ <><><>

Tuesday, December 29, 2015

<> <> HOT NEW LISTING FROM ADVANTAGE REAL ESTATE <><>

<><> DESERT LIVING AT IT'S BEST JUST HIT THE MARKET ! <><> THIS IS A DESERT DREAM <><> Located in Indio and Built in 2007 ... This is a 3-Bd/ 3-Bath Home with 2,112 sf. to Enjoy and a large Lot of 8,276 sf. <><><> Listed at Only $518,800.00 <><><> Want to know more or view this home??? Just pick up your phone and call Cj at 909.910.2481 <><>

Monday, December 28, 2015

*** MARKET HOT SPOTS ***

<><><> ARE YOU LOOKING TO MOVE ?? <><><> CALL ME WITH ANY QUESTIONS AS TO HOW TO START <><><> 909.910.2481 Cj <><><>

Wednesday, December 23, 2015

Saturday, December 19, 2015

?~?~? DID YOU KNOW ?~?~?

*** FOLKS .... DID YOU KNOW BY PUTTING A FRESH COAT ON YOUR FRONT DOOR CAN INCREASE YOUR HOME VALUE .... Yes, your front door greets your guests or potential Buyers and how it looks leaves an impression of things to come !!! *** 909.910.2481 ***

Friday, December 18, 2015

** CHINO,CA. HOUSING TRENDS **

This information was compiled by WFG National Title Company .... Any questions regarding the Chino Market ... Give me a call at 909.910.2481

*** I'M THAT ONE ~ BUT ***

*** Yes, Folks .... I am that one who loves to laugh & fool around ... BUT .... I get the job done with maintaining Your Best Interest in mind through the whole transaction. *** Call me at 909/ 910-2481 = Cj with a Smile ***

Thursday, December 17, 2015

Sunday, December 13, 2015

OVERDUE QUALITY TIME WITH OLD FRIENDS

*** FOLKS .... A LITTLE PEEK ... THIS WAS AN EARLY CHRISTMAS GET TOGETHER ( LAST WEEKEND ) WITH SOME OLD FRIENDS THAT WAS WAY OVERDUE ... FUN !!! ***

Friday, December 11, 2015

Wednesday, December 9, 2015

~~~~ FIRE SAFETY ~~~~

Hi Folks! This is the Season!!! So, Here are some Safety Tips and Call me if you would like a new Home around a new Fireplace at 909.910.2481 ** Cj ** ******************************************************************************************************************************************************************************* Residential fires take their toll every day, every year, in lost lives, injuries, and destroyed property. According to the National Fire Protection Association, a home structure fire was reported every 86 seconds in the U.S. in 2014. The fact is that many conditions that cause house fires can be avoided or prevented by homeowners. Taking the time for some simple precautions, preventive inspections, and concrete planning can help prevent fire in the home - and can save property and lives should disaster strike.

• All electrical devices including lamps, appliances, and electronics should be checked for frayed cords, loose or broken plugs, and exposed wiring. Never run electrical wires, including extension cords, under carpet or rugs as this creates a fire hazard.

• Fireplaces should be checked by a professional chimney sweep each year and cleaned if necessary to prevent a dangerous buildup of creosote, which can cause a flash fire in the chimney. Cracks in masonry chimneys should be repaired, and spark arresters inspected to ensure they are in good condition and free of debris.

• When using space heaters, keep them away from beds and bedding, curtains, papers - anything flammable. Always follow the manufacturer's instructions for use. Space heaters should not be left unattended or where a child or pet could knock them over.

• Use smoke detectors with fresh batteries unless they are hard-wired to your home's electrical system. Smoke detectors should be installed high on walls or on ceilings on every level of the home, inside each bedroom, and outside every sleeping area. Statistics show that nearly 60% of home fire fatalities occur in homes without working smoke alarms. Most municipalities now require the use of working smoke detectors in both single and multi-family residences.

• Children should not have access to or be allowed to play with matches, lighters, or candles. Flammable materials such as gasoline, kerosene, or propane should always be stored outside of and away from the house.

• Kitchen fires know no season. Grease spills, items left unattended on the stove or in the oven, and food left in toasters or toaster ovens can catch fire quickly. Don't wear loose fitting clothing, especially with long sleeves, around the stove. Handles of pots and pans should be turned away from the front of the stove to prevent accidental contact. Keep an all-purpose fire extinguisher within easy reach. Extinguishers specifically formulated for grease and cooking fuel fires are available and can supplement an all-purpose extinguisher.

• Have an escape plan. This is one of the most important measures to prevent death in a fire. Visit ready.gov for detailed information on how to make a plan. Local fire departments can also provide recommendations on escape planning and preparedness. In addition, all family members should know how to dial 911 in case of a fire or other emergency.

• Live Christmas trees should be kept in a water-filled stand and checked daily for dehydration. Needles should not easily break off a freshly-cut tree. Brown needles or lots of fallen needles indicate a dangerously dried-out tree which should be discarded immediately. Always use nonflammable decorations in the home, and never use lights on a dried-out tree.

• Candles add a festive feeling, and should be placed in stable holders and located away from curtains, drafts, pets, and children. Never leave candles unattended, even for a short time.

• Christmas lights should be checked for fraying or broken wires and plugs. Follow the manufacturer's guidelines when joining two or more strands together, as a fire hazard could result from overload. Enjoy indoor holiday lighting only while someone is home, and turn them off before going to bed at night.

Tuesday, December 8, 2015

*** GEORGE ASKED ME ***

*** TEE HEE *** GEORGE ASKED ME TO SHARE HIS GREETINGS *** HE WANTED TO MAKE SURE HE REACHED ALL OF YOU

!~!~! *** GETTING READY FOR THE CHRISTMAS CELEBRATION ***

Thursday, December 3, 2015

Monday, November 30, 2015

FEELING SHORT ON ELBOW ROOM ?

*** Hi Folks *** Hope everyone had a great Thanksgiving *** While celebrating, did you feel the walls moving in on you? *** Ready to expand a bit? *** Call me at 909.910.2481 for the help needed to complete Your Dream ***

Monday, November 23, 2015

*** THANKSGIVING BLESSINGS ***

**** HELLO FOLKS **** I WANT TO WISH EVERYONE A WARM AND BLESSED THANKSGIVING ! ENJOY EVERY MINUTE YOU HAVE WITH YOUR FAMILY AND FRIENDS ON THIS VERY SPECIAL DAY. IT IS A FAVORITE OF MY FAMILY AND WE ENJOY ALL THE "CRAZINESS" THAT COMES WITH THIS WONDERFUL TIME TOGETHER **** WITH A VERY WARM HEART, I WISH YOU A VERY HAPPY THANKSGIVING ****

Saturday, November 21, 2015

**** CLOSED ESCROW NOV.17th ****

**** Howdy Folks ... Buyer is moving in !~!~! AND Happy !~!~! This is a 3-Bd/2-Bath Home located in Covina, Ca. with a large lot of 10,237sf and 1,743sf of living space *** Listed at $520,000 ... Sold at $505,500 .... EVERYONE IS HAPPY,HAPPY, HAPPY! .... THINKING OF BUYING OR SELLING CALL CJ AT 909.910.2481 ****

Sunday, November 15, 2015

** 5 WAYS YOU DIDN'T KNOW YOU COULD SAVE FOR A DOWN PAYMENT **

********* HI FOLKS .... IF YOU HAVE QUESTIONS AFTER THIS READ ... GIVE ME A CALL AT 909.910.2481 ********* By: Erik Sherman ****** Buying your first home conjures up all kinds of warm and fuzzy emotions: pride, joy, contentment. But before you get to the good stuff, you've got to cobble together a down payment, a daunting sum if you follow the textbook advice to squirrel away 20% of a home's cost.

Here are five creative ways to build your down payment nest egg faster than you may have ever imagined.

~~~ 1. Crowdsource Your Dream Home ~~~

You may have heard of people using sites like Kickstarter to fund creative projects like short films and concert tours. Well, who says you can't crowdsource your first home? Forget the traditional registry, the fine china, and the 16-speed blender. Use sites like Feather the Nest and Hatch My House to raise your down payment. Hatch My House says it's helped Americans raise more than $2 million for down payments.

~~~ 2. Ask the Seller to Help (Really!) ~~~

When sellers want to a get a deal done quickly, they might be willing to assist buyers with the closing costs. Fewer closing costs = more money you can apply toward your deposit.

"They're called seller concessions," says Ray Rodriguez, regional mortgage sales manager for the New York metro area at TD Bank. Talk with your real estate agent. She might help you negotiate for something like 2% of the overall sales price in concessions to help with the closing costs.

There are limits on concessions depending on the type of mortgage you get. For FHA mortgages, the cap is 6% of the sale price. For Fannie Mae-guaranteed loans, the caps vary between 3% and 9%, depending on the ratio between how much you put down and the amount you finance. Individual banks have varying caps on concessions.

No matter where they net out, concessions must be part of the purchase contract.

~~~ 3. Look into Government Options ~~~

The U.S. Department of Housing and Urban Development, or HUD, offers a number of homeownership programs, including assistance with down payment and closing costs. These are typically available for people who meet particular income or location requirements. HUD has a list of links by state that direct you to the appropriate page for information about your state.

HUD offers help based on profession as well. If you're a law enforcement officer, firefighter, teacher, or EMT, you may be eligible under its Good Neighbor Next Door Sales Program for a 50% discount on a house's HUD-appraised value in "revitalization areas." Those areas are designated by Congress for homeownership opportunities. And if you qualify for an FHA-insured mortgage under this program, the down payment is only $100; you can even finance the closing costs.

For veterans, the VA will guarantee part of a home loan through commercial lenders. Often, there's no down payment or private mortgage insurance required, and the program helps borrowers secure a competitive interest rate.

Some cities also offer homeownership help. "The city of Hartford has the HouseHartford Program that gives down payment assistance and closing cost assistance," says Matthew Carbray, a certified financial planner with Ridgeline Financial Partners and Carbray Staunton Financial Planners in Avon, Conn. The program partners with lenders, real estate attorneys, and homebuyer counseling agencies and has helped 1,200 low-income families.

~~~ 4. Check with Your Employer ~~~

Employer Assisted Housing (EAH) programs help connect low- to moderate-income workers with down payment assistance through their employer. In Pennsylvania, if you work for a participating EAH employer, you can apply for a loan of up to $8,000 for down payment and closing cost assistance. The loan is interest-free and borrowers have 10 years to pay it back. Washington University in St. Louis offers forgivable loans to qualified employees who want to purchase housing in specific city neighborhoods. University employees receive the lesser of 5% of the purchase price or $6,000 toward down payment or closing costs.

Ask the human resources or benefits personnel at your employer if the company is part of an EAH program.

~~~ 5. Take Advantage of Special Lender Programs ~~~

Finally, many lenders offer programs to help people buy a home with a small down payment. "I would say that the biggest misconception [of homebuying] is that you need 20% for the down payment of a house," says Rodriguez. "There are a lot of programs out there that need a total of 3% or 3.5% down."

FHA mortgages, for example, can require as little as 3.5%. But bear in mind that there are both upfront and monthly mortgage insurance payments. "The mortgage insurance could add another $300 to your monthly mortgage payment," Rodriguez says.

Some lender programs go even further. TD Bank, for example, offers a 3% down payment with no mortgage insurance program, and other banks may have similar offerings. "Check with your regional bank," Rodriguez says. "Maybe they have their own first-time buyer program."

Not so daunting after all, is it? There's actually a lot of help available to many first-time buyers who want to achieve their homeownership dreams. All you need to do is a little research -- and start peeking at those home listings!

Wednesday, November 11, 2015

Friday, November 6, 2015

**** OPEN HOUSE SUNDAY NOV. 8th ****

~~~ HI FOLKS ~~~ OPEN THIS SUNDAY, A WONDERFUL NORTH UPLAND HOME, FROM 1:00PM TO 3:30PM ~~~ 1688 MAYWOOD AVE. IN UPLAND ... LOOK FOR MY SIGNS AT MOUNTAIN AVE. & 16th ST. ... LISTED AT ONLY $478,500 ... 3BD/ 2 BATH; 1400sf WITH 7500sf LOT ... OH MY COME SEE FOR YOURSELF !!!! OR FOR MORE INFORMATION CALL 909.910.2481 ~~~~

Tuesday, November 3, 2015

** 6 Things New Homeowners Waste Money On **

Hi Folks .... Just an FYI for you .... Also help is at the end of the line at 909.910.2481 *************** OK, we’ve said it time and again, but it bears repeating: Buying a home is a very big expense—and once you’ve kicked off all that spending, it’s easy to find yourself caught up in rampant lifestyle inflation. After all, you’ve got an enormous, shiny new house just waiting to be filled with all sorts of nice stuff, right?

Well, take some quick advice: Don’t keep spending.

Homeownership comes with its fair share of unique costs—property taxes and urgent repairs and energy bills, oh my. There’s no need to add to their cost by shelling out for unnecessary expenses. Here are six major cash outlays that buyers can avoid.

~~~ Too much house ~~~

This one requires some thought before you actually nail the deal: How much house do you really need? Just because you’re pre-approved for a hefty purchase price doesn’t mean you should go as big as you can.

“The house that you can afford with the money you’re lent can make the budget go out of whack,” says Andrew Gipner, a financial adviser at Longview Financial Advisors in Huntsville, AL.

Not sure where to trim? Consider having less closet space, buying fewer bedrooms, or—especially—eliminating a formal dining room.

“You don’t use the dining room nearly as often as you think,” says Noelle Hans-Daniels, a Sotheby’s Realtor® in Indianapolis. “It’s kind of a wasted space.”

~~~ Fixing up your outdoor space ASAP ~~~

Once you close on your home and move in, you might be itching to host your first late-season barbecue. Or maybe you’ve been dreaming about a koi pond, like, forever. But hold on: Updating your outdoor space shouldn’t be your first priority, especially if you’re tight on cash. Unlike couches and beds, which are essential to a functioning house, landscaping and decor can be put on pause.

That goes double if you’re building new: According to Hans-Daniels, building your backyard at the same time as your home can cost “a lot more than if you did it after the fact.”

So exercise some caution before committing: Try pricing out your plans with a landscape contractor, and consider rolling them out in phases.

~~~ Old, outdated insurance ~~~

Still using the same company that offered you renters insurance seven years ago? It might be time for a change. Shop around.

“You may stay with the same company, but you may find something that’s a little better price for the same thing,” Gipner says. “Sometimes, people may not want to shop around or may be married to a particular company.”

Just because the same company had a good deal on auto or renters insurance doesn’t mean it’s the best fit to protect your home. Go through all your options with a fine-toothed comb, looking for a deal that won’t crush you financially but also leaves your house and its belongings secure.

After all, now it’s not just your stuff—it’s your roof, yard, and foundation you have to protect, too.

~~~ Space-filling stuff ~~~

If you’re moving from an apartment, chances are good you’re astounded by how much space you have. There’s another bedroom and a dining room and … yet another bedroom!

Don’t feel like you have to fill it all at once. Give yourself—and your home—time for personality to emerge.

“A lot of people will go out and say, ‘Oh my gosh, I’ve got to fill this space and buy stuff,’” Gipner says. “I’m not against possessions, but the way some people do it can be seriously detrimental to their finances.”

Instead of immediately stuffing the TV room with a generic, new couch and coffee table, wait it out. See what you really need and what you really like. In the meantime, stick the money you save into a renovation fund.

~~~ Extended warranties ~~~

Many homes don’t come with appliances installed, so first-time homeowners might find themselves making large purchases (like a dishwasher or refrigerator).

Here’s a tip: You don’t need the extended warranty.

“I’m against them,” Gipner says. “What are the chances everything you own is going to break or not work anymore?”

Yes, something might break within the relatively slim service window—but the money you’ll spend fixing one thing will be far less than the extended warranties on all the things. Your average warranty costs about $123 for major appliances, according to Consumer Reports, and a single repair costs not much more (and might not even be covered). Just risk it—you’ll come out ahead in the long run.

Yard maintenance

Having your own yard is definitely exciting, and while it’s important to keep it healthy and watered, you don’t need to go overboard. Resist the pressure to hire additional help for your yard—even if you’ve lucked into an HOA that covers it.

“You can still be part of an HOA and cut your own grass,” Gipner says. “You don’t have to pay someone an exorbitant amount of money to come out and cut your grass.”

Don’t be tempted by the sales pitches you’ll inevitably receive after your purchase goes through. A gorgeous lawn is achievable—and it can be done all on your own. Really.

By: Jamie Wiebe

Thursday, October 29, 2015

\\\\\\\\\\ BE CAREFUL THIS WEEKEND //////////

<<<<<<<< STRANGE THINGS HAPPEN ON OCTOBER THE 31st !!!! >>>>>>>> WALK WITH EYES OPEN AND RUNNING SHOES ON !!! <<<<<<<< HAPPY HALLOWEEN FROM Cj .... AND PRAY YOU RUN FASTER THEN THEY DO !!!! >>>>>>>>

Tuesday, October 27, 2015

*** DON'T HAVE ONE ??? ***

#!#!# LET ME GET YOU FROM START TO HANDING OVER KEYS #!#!# AND I LOVE REFERRALS ... TREAT ALL MY CLIENTS WITH THE UTMOST CARE #!#!# CALL ME AT 909/ 910.2481 .... CJ #!#!#

Tuesday, October 20, 2015

@@@ OPENED ESCROW YESTERDAY @@@

~~~ HOWDY FOLKS ~~~ Well Opened Escrow yesterday for my Buyer !~! This is a 3Bd/ 2 Bath Home located in North Covina,Calif. ~ It has 1,743 sf. of Living Space and the Lot equals 10,237 sf.; Built in 1953; has Beautiful, Original Hardwood Flooring, 2 Fireplaces; 2 car attached Garage w/ direct access; Multiple Fruit Trees and much more !~!~! Listed at $520,000 ~~ Happy, Happy Buyer ~~ Think you can't Buy ? Lets Just See .... Call me at 909.910.2481 Cj ~~~

Thursday, October 15, 2015

~?~?~?~ DO YOU THINK WE CAN ~?~?~?~

*** HI FOLKS *** HAVE YOU ASKED YOURSELF THIS QUESTION? HAS THAT THOUGHT CROSSED YOUR MIND? *** WELL, MANY DON'T THINK THEY CAN, UNTIL THEY TALK TO A REAL ESTATE PROFESSIONAL AND FIND OUT THEY REALLY CAN !! ... LET ME HELP YOU GET READY TO COMPLETE YOUR GOAL OF THAT FIRST PURCHASE. CALL ME FOR THE HELP NEEDED TO GET THERE AT 909/ 910.2481 .... I AM WAITING ON THE OTHER END TO GET YOU WHERE YOU WANT TO GO .... Cj ***

Sunday, October 11, 2015

~~~~ OPEN HOUSE TODAY ~~~~

<<< COME TO VIEW THIS WONDERFUL HOME IN NORTH UPLAND >>> 1688 MAYWOOD AVE. <<< OPEN FROM 1:00 PM TO 3:30 PM: 3-BD/2 BATH; LISTED AT $478,500 >>> QUESTIONS AT 909.910-2481 <<< SEE YOU THERE >>>

Friday, October 9, 2015

MY NEW NORTH UPLAND LISTING

<<< HI FOLKS >>> Check out my new Listing in North Upland ** Very Nice Single Story that is a 3-Bd & 2-Bath Home; 1,400 sf.; Lot is 7,500 sf; w/ DBL Door Entry and Beautiful Dark Wood Laminate flooring; Lg Master Suite w/ Computer Desk/Media Nook & Walk-In Closet ** So much more to this great listing *** OPEN HOUSE THIS WEEKEND FROM 1:00 PM TO 3:30 PM ~~ 1688 Maywood Ave. ** listed at only $478,500 ** Call Cj with any questions at 909.910.2481 >>>

Monday, October 5, 2015

~~ VACATION OVER & I'M BACK ~~

*!*!*!* HOWDY FOLKS .... Yes, we took a week off & had a great time of not doing Anything .... Went for the "HOT" Weather, Turned off All our Devices, Friends joined us for a couple of days and just completely relaxed *!*!* Everyone cooled off But now it is time to get going again *** NEED HELP WITH BUYING OR SELLING CALL ~ Cj @ 909/910.2481 ~ AND KEEP AN EYE OUT FOR MY NEW LISTING THIS WEEK .... TEE HEE ... MY "DEVICE" IS BACK ON *!*!*!*

Subscribe to:

Posts (Atom)